Q3 2023 MARKET COMMENTARY

Q3 started off in positive fashion with US Stock Indices making relative progress while interest rates remained stable. However, during the month of July, we saw the 10 yr. US Treasury fall to around 3.7% before zooming to almost 4.7% by the end of September – the highest 10 yr. rates we’ve seen since 2007 (Before the Financial Crisis). We believe it’s this rapid rise in interest rates during the quarter that was the largest contributor to the sell-off witnessed in most assets during August and September. In the commentary to follow, we’ll discuss why debt markets, interest rates and credit are so important to investors and their ability to generate positive returns from their diversified portfolios.

Normally the stock indices tend to steal the show as they contain household names that we know and love, but for this Quarterly Commentary, I wanted to spend most of the time on the Debt Markets. With interest rates being so artificially depressed by Major Global Central Banks over the last decade – there’s been little to no reason to spend much time talking about debt in general. It was clear that if you wanted a real return after inflation, you had a better chance of achieving that with Equities or Real Estate. However, with the steep and swift rise in short (Fed Funds) and long-term rates (US 10 & 30 yr. Treasuries) over the last 18-24 months it’s clear that the Bond Market is in charge of what happens in Capital Markets right now.

Why are interest rates so important? The answer is straight forward – The US Treasury Market effectively sets the Discount Rate for how all other assets are to be valued. Because the US Govt. can print its own currency and repay any debts with that currency, it’s perceived that US Treasury Debt (Bonds or Bills) have zero chance of default – therefore they establish the “Risk Free Rate”. The Market deems that all other investments therefore have some measure of risk more than a US Treasury. When US Treasury Rates are low – investors are willing to also take lower rates of return (Effectively Paying Higher Prices) on those assets. That’s exactly what we have seen since the Great Financial Crisis across the globe. As rates went lower – Stock, Price to Earnings went higher (As did the Stock Prices), Real Estate Cap Rates went lower (Helping building values to rise) and Bond prices went higher (As their yields generally dropped in a relationship with US Treasuries). Rates Down – Values Up – Simple.

As a common saying goes, “What goes up, can also come down” – as interest rates have risen consistently since the absurd Covid Lows – We’ve seen markets stuck in a range that hasn’t been productive unless you’re a talented trader. Equities managed to get a shot in the arm along with Real Estate in the back half of 2020 into the first three quarters of 2021 due to the incredible monetary stimulus provided by the Federal Govt. to the Economy and Markets. But neither asset class has been able to return to the highs reached in Q4 of 2021. We still hear stories of residential properties trading at all-time high prices, but those cases are due to the anomaly of absurdly low inventory in certain parts of the country and buyers’ willingness (Rightly or wrongly) to pay those prices. Higher rates have occurred because of the reemergence of much higher inflation, created by a number of issues 1) Lack of enough housing supply 2) Lack of Enough Workers 3) Too much monetary stimulus 4) Disrupted Supply Chains (Largely solved at this juncture). In response the Federal Reserve has been on a mission to “Tighten Monetary Conditions” – which is code for raise interest rates to slow down consumption and investment – not directly, but by making the cost to finance those transactions more difficult, even punitive. The problem is the Federal Reserve only directly controls short term rates via the Fed Funds Rate – a term often talked about in the financial press but frankly doesn’t have quite as much relevance to the common investor. The Fed Funds Rate is simply what the Federal Reserve is willing to pay banks to park their excess deposits with it overnight as opposed to using it for some other purpose like lending (Which may carry higher returns, but also more risk). The Fed Funds Rate doesn’t really influence too much of what we might do in the context of borrowing to help facilitate purchases. Longer-term rates (5, 10, 30 year rates), which the Fed can’t directly control but can influence, do affect us in a more direct fashion. They determine our rate on our Car Loan, our Mortgage, our Credit Card balances (Hopefully we pay them off in full monthly!). Those are rates that just affect us as consumers. What about people who want to start or expand a business and need an SBA Loan? Or companies that want to purchase competitors, or borrow to expand, etc.? The cost of capital has gone up so much that you must think twice about making the purchase or business transaction. It’s a slow process but rest assured, higher interest rates have proven in past economic cycles to have the ability to send economies into Recessions.

If it hurts those who need to borrow at today’s elevated interest rates, then it must benefit those who lend – right?! Gold Star to you for putting that together. This is the message we’ve been trying to relay to our clients here in 2023 – Being the lender may be one of the best strategies in today’s environment. But what does that mean? Am I going to start advertising to my family, friends, co-workers that they can come to me for a loan?! While you could do that, we’d advise against it. Being a Lender – or effectively investing in debt can be a tricky undertaking. The Debt Markets globally are many times larger in value than the Equity Markets, which is why when we have a Debt Crisis, they are so much more important to our Central Bankers than sell-offs in the Equity Market. When contemplating making a debt investment – you effectively are underwriting a loan to an entity – it could be the Federal Govt. (Treasury Bills or Bonds), a Municipality (City, State), Corporation (Some are Highly Rated – what we call ‘Investment Grade’, some are Poorly Rated – what we call ‘High Yield’). When deciding whom you want to lend your money to, as investor, you must determine the “Credit Worthiness” of the borrower. Most of us frankly have not been taught the proper set of financial skills to do that with any sort of consistency, therefore investors either pool their investments through Mutual Funds or ETFs to gain access. For those that opt to buy individual bonds they may rely on a bond’s rating – in our opinion we wouldn’t recommend solely relaying on the Ratings Agencies (Standard & Poors, Moody’s & Fitch) who have a history of being wrong or worse yet conflicted! Lehman Brothers was an A-Rated Investment Grade Credit all the way until the day it closed its doors in bankruptcy. We describe this part of the investment landscape as “Credit Risk” – if I give you my capital, will you pay me the interest and principal back that I am owed? We have found that when we are investing in the highest-grade debt securities, we are comfortable owning them directly as individual bonds/bills or through low-cost passive ETFs. However, when we are looking to own lower rated debt securities that can generate higher returns but also higher losses, we prefer to bring in professional Managers via Mutual Funds, Active ETFs or Private Debt Pools to help properly manage the credit risk.

The next decision that a debt investor must tangle with is whether to own fixed-rate debt or floating rate debt. In a rising interest rate environment, floating rate debt can outperform as the lender/investor will receive a higher rate of interest as the interest rates move higher and the debt instrument adjusts its interest payments accordingly. Because the rate is variable the price is generally stable so long as the creditworthiness of the borrower does not substantially change. A fixed rate debt instrument, because its interest payments are in fact fixed, will see the value of the bond drop to adjust for the higher rates now available to investors in the market. When you hear of bond investors losing money in a rising rate environment, it’s fixed rate debt that they are referring to. Simply put – in a rising interest rate environment an investor wants to own more Floating Rate Debt, in a falling interest rate environment you’ll want to own more fixed rate debt.

The final piece to consider within the interest rate conversation is Duration Risk. Duration Risk has been explained in a few ways 1) The length of time it will take you to receive your money back 2) The sensitivity of the debt instrument to moves up or down in interest rates. If you own a very short-term debt instrument like a 3-month corporate bond, it will have very little duration or interest rate sensitivity. If you own a 30 yr. corporate bond, that debt instrument will have an outsized amount of duration or interest rate sensitivity. Professional investors understand how to maximize returns through properly maximizing or minimizing duration in their portfolios in addition, often, to managing their credit risk.

With rates as high as they are currently in the US, it’s clear that debt investors can once again make returns that could be competitive with equity investors with perhaps more certainty around returns (Due to the higher interest rates being received). During 2023 we’ve gotten parts of our strategy correct – namely our exposure to floating rate debt instruments like Treasury Bills and Private Credit. We have however, had a tough time in owning some of our favorite Core Bond Managers, High Yield Municipal Managers, and long-dated Treasuries. We still favor taking duration risk over taking Credit Risk currently – but that may change as we move into 2024. If the economy slows and Credit Spreads widen out substantially, we will probably reallocate out of our High-Grade Treasury Bond Allocations into more Credit Sensitive Investments. For now, we are only willing to take credit risk via our Private Credit Investments and High Yield Municipal Bond Funds. In both cases we feel like the managers have a handle on the underwriting of risk in both of these markets.

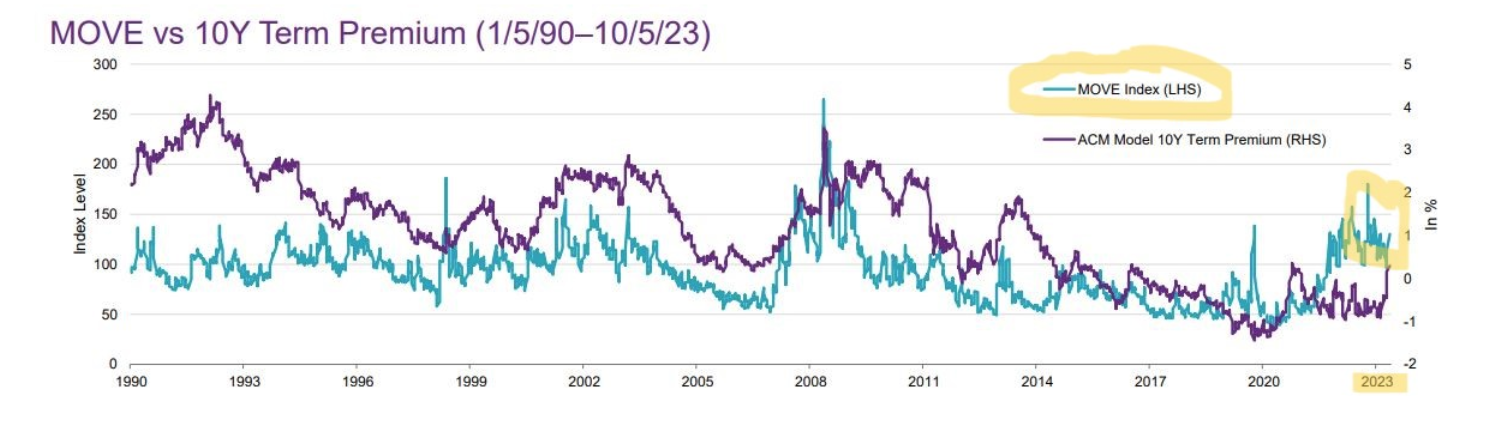

As we enter the final quarter of the year, if we are to have any hope at a year end rally, it will be imperative that interest rates stop moving higher and begin to trade in a more predictable range. Volatility as measured by the “Move Index” – the way we measure the volatility in rates has been too high.

When rates are moving all over the place it makes it difficult for investors to know if they are paying the right price to own an asset. When large investors aren’t as clear about the value they are receiving on their investments they are prone to de-risk or in other words become less invested and hold more cash. When confidence is running high, investors are generally more invested and returns generally more robust. For our investors we continue to be watchful for opportunities, but we also remain less fully invested in the current environment. We do not feel like the stock market’s current pricing may properly reflect weakening earnings from companies and the new higher interest rate environment. We are trying to be selective with allocating our client’s capital looking for companies that may have troughed their earnings drawdowns and have an earnings yield at least in excess of the 10 year treasury. We do not believe investors will be well served with their returns by chasing higher valuation stocks in the current environment. Every economy and market has a cycle – we will feel more comfortable increasing our client’s exposure to risk, if we can get valuations to come down to more attractive entry points in which to deploy capital that we are keeping in reserve in cash/treasury bills.

PO BOX 231030, Encinitas, CA 92023 | 760-602-6920 | info@koawealth.com

This material should not be considered a recommendation to buy or sell securities or a guarantee of future results. Koa Wealth Management, LLC is a registered investment adviser. Registration does not imply a certain level of skill or training. More information about Koa Wealth Management, LLC can be found in our Form ADV Part 2, which is available upon request or by visiting our website at www.koawealth.com/disclosure. Past performance is not a guarantee of future results. All investment strategies have the potential for profit or loss; changes in investment strategies, contributions, or withdrawals may materially alter the performance and results of a portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Sources:

[1] Hedgeye