Q2 2023 MARKET COMMENTARY

It’s hard to believe we have hit “Half Time” in 2023. If you had asked me on January 1st of this year that we’d have No Major Credit Market Disruptions, Residential Real Estate prices would be buoyant and the 7 largest Tech Stocks in the Market would have accounted for the majority of positive US Equity Market Returns this year – I would have said “No way Jose!”. Yet that’s exactly where we sit as I hammer my keyboard (Along with a Skittles Flavored C4). Socrates once said, “Knowledge is knowing that you know nothing” – I will not even venture a guess as to what the back half of the year will bring, as clearly my powers of prognostication aren’t going to help us make money. What we will, however, discuss are our observations and give you our best thoughts on what we are seeing and how we gauge current opportunities and risks in the market.

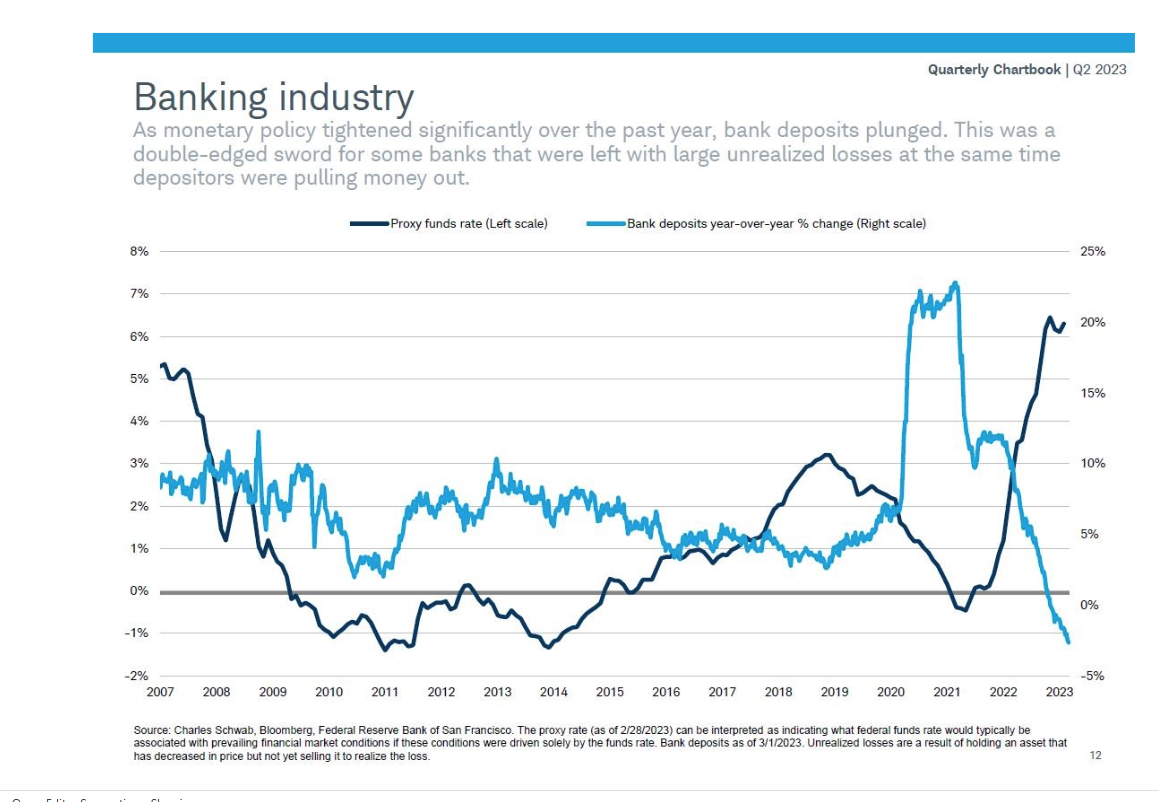

In Q1, we opined on the failures of Silicon Valley Bank, Signature Bank, First Republic, etc. and much to our surprise those bank failures were well contained. The Fed made a shrewd move in allowing banks to park their bonds at the Fed for up to a year and receive a loan at par value for those bonds. This allowed banks who would have taken large losses had they been forced to sell their bonds to be able to get the liquidity to their depositors that requested it without taking large hits to their equity. With the lack of negative headlines in the subsequent weeks, the waters were able to calm, allowing banks to raise deposit rates, sell assets they could sell, etc. While the shifting deposits have calmed for now, we still have concerns regarding bank curtailment of lending. We hear story after story of Private Lenders stepping in to fill the void left by banks in markets where they would typically provide liquidity. The money is still out there, but at a MUCH higher cost than we’ve seen in the last decade. As more companies, real estate owners, etc. must come to the market to refinance current low-rate debt or take out additional debt, they will find their interest expense much higher and the returns on their assets, projects, etc. potentially much lower. In addition, the Yield Curve is as inverted as we’ve seen over the last year with the 3-month Treasuries closing at 5.38%- and 10-year Treasuries closing at 4.03% today a 135 basis point inversion. As seen in the chart below, the longer the curve stays inverted, the more pressure will be on the banks to pay depositors a higher rate of interest to keep them from moving their cash into US Treasury Bills and Money Market Funds. The banks have been given a lifeline by the Fed, but it doesn’t mean they still aren’t swimming with sharks in the water.

To our earlier comment with rates elevated by the Fed and lenders less willing to lend of late, we continue to look for what think are and could continue to be great risk adjusted returns in debt markets. For the investor looking for a “Safe Yield” while they figure out what to do with their cash, we continue to invest our clients into US Treasury Bills paying in excess of 5%. Not only are yields higher than what the banks are generally paying, instruments are far more liquid, and the interest is not subject to taxation by the State (Federal Tax is still owed) – Winning! For investors looking for a hedge in their portfolio against a recession, we would offer 30-year Treasury Bonds, which closed a hair over 4% today as an opportunity. With 30 yr. treasury bonds so low in yield 18 months ago, they were not a particularly useful hedge for a portfolio, but now at these higher rates, we believe there’s ample room for yields to fall in a recessionary scenario providing terrific price improvement (Due to duration) for these bonds. For investors that are willing to take some credit risk with proper underwriting, we’ve been taking advantage of the void left by the banks in lending to Private Equity backed companies. There’s more money raised by Private Equity than ever before providing a huge pool of financial support for these companies and protecting our Senior Secured Loans. With yields in the 9-10% range currently, we believe our investors are being paid handsomely whether we continue to coast along or if storm clouds start to gather. Finally, we are starting to talk with our clients about Distressed Debt. While we saw a brief credit cycle in 2020 due to Covid, the last great opportunity in Distressed Debt was back in 2008-2009. It’s been a looooong time since we’ve seen a rash of bankruptcies and with low interest rates for a protracted period, we’ll make a wager that their may be a lot of good businesses who unfortunately are looking at bad balance sheets as they look to refinance that debt over the next 2 years. Because of the complexity involved in Distressed Debt, you want to stick with very experienced hands – but we feel like we can win here whether we get a mild or major credit cycle at some point as we move forward.

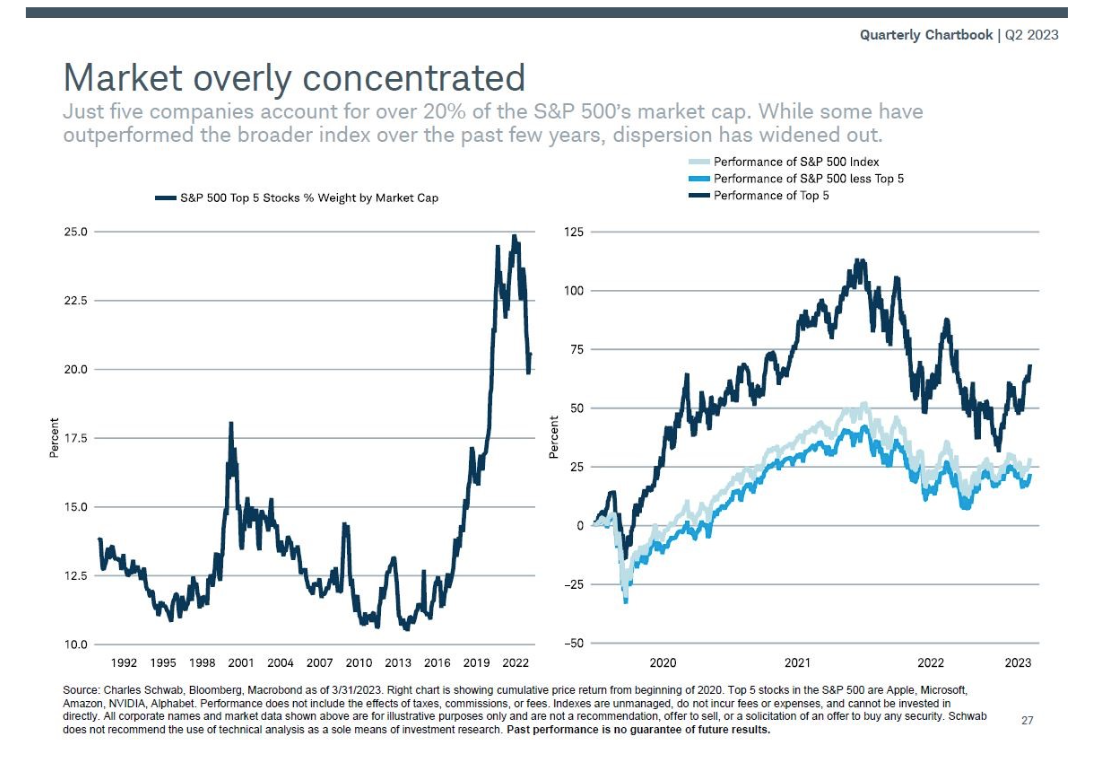

If you’ve been a Financial Advisor in the US for the last 20 years, you know how much your clients looooove their Tech Stocks – especially those household names that everyone and their barber knows. And why not, those stocks have made a lot of people a lot of money. As an advisor though who’s seen a couple of booms and busts during that 20-year career, I sometimes feel like a nagging mother pointing out how those stocks have become a larger and larger part of our client’s portfolios – almost like a weed that takes over the whole garden. I find that telling our clients the facts is one thing – but showing them a picture to highlight it is another. The chart below shows not only how much the top 5 Tech stocks have attributed to returns (In this case the S&P 500) but also how much of the Index is now devoted to those 5 names – Wow! We are glad we own 4 of the 5 and have for many years now, but we do worry that at some point growth will slow, valuations will cease to make sense and someone (As they always seem to) will be holding the bag.

While we continue to be cautious of the broad US Large Cap Indexes that are heavily leveraged to these large tech names. We find the valuations of much smaller cap companies in the US to be rather compelling. When I was taught asset allocation in the beginning of my career, it was a statistical fact that Small/Micro Cap Companies over time would deliver higher returns due to their growth for which you would have to suffer higher volatility. If you look segments (Large. Mid, Small/Micro) over the last decade, they’ve essentially been turned on their head. US Small/Micro Cap companies on avg. now trade at much lower valuations than their large cap brethren, but still present the same growth and M&A buyout opportunities that they always have. While it’s hard to sell out of the Large Cap tech stocks that have been performing to swap for US Small/Micro Caps that have not, if investors are looking for the next opportunity that’s contrarian/unloved – we’d submit this area of the market for review.

Our final area of coverage is Real Estate. We continue to see articles written weekly of Office Properties globally going into special servicing (Industry speak for going back to the lender), but by and large we are yet to see an avalanche of defaults in the Commercial Real Estate market. Perhaps tougher times are still to come in 2024, but we try to remind our investors that Real Estate is an investment you make for the long term. Bought properly, it has always been an asset that the wealthiest in society own not only to get wealthy but to stay wealthy. By and large we continue to hang onto our positions in our Private REIT portfolios despite the slow drift downward in their NAVs over the last 10 months (After a productive 3-4 years of ownership). It’s been educational to see how our three main sponsors in the CORE space have managed through the last year. The largest of the three has been very intentional with recycling capital in their portfolio and given the current uncertainty has done a pretty good job of raising fresh capital for the fund. While the NAV does not yet show the fruits of their labor, we believe the work they are doing will result in returns that could start to separate them from their competition when tailwinds return to Real Estate. The second provider, the mid-size of the three, has taken a very different approach. They are selling assets but only to meet investor demands for liquidity, they are not reinvesting in newer buildings with fast growing rent rolls. Their capital raising has also been lacking, putting more stress on the Portfolio Managers to make sure they have the liquidity necessary to meet their investor demands on a monthly basis. For clients that are requesting funds from their Real Estate assets, this has been the holding we have been recommending for redemption. The third and smallest of the three has also been sitting quietly but has not had the stresses of elevated redemptions from its shareholders so it hasn’t needed to sell any assets out of the portfolio. Three world class asset managers in the Real Estate field, but three completely different situations/approaches. In our opinion the mark of a manager isn’t so much in how they manage through easy/good times, but rather how they navigate the tough times.

PO BOX 231030, Encinitas, CA 92023 | 760-602-6920 | [email protected]

This material should not be considered a recommendation to buy or sell securities or a guarantee of future results. Koa Wealth Management, LLC is a registered investment adviser. Registration does not imply a certain level of skill or training. More information about Koa Wealth Management, LLC can be found in our Form ADV Part 2, which is available upon request or by visiting our website at www.koawealth.com/disclosure. Past performance is not a guarantee of future results. All investment strategies have the potential for profit or loss; changes in investment strategies, contributions, or withdrawals may materially alter the performance and results of a portfolio. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Sources:

[1] Hedgeye